how long does the irs have to collect back payroll taxes

Under this rule you dont pay tax on income you earn from the short-term. For a payroll deduction installment agreement submit Form 2159.

Irs Tax Refunds What Is Irs Treas 310 Marca

The IRS is generally prohibited from levying and the IRSs time to collect is suspended or prolonged while an OIC is pending for.

. Guaranteed Installment Agreement If your tax debt is no more than 10000 your installment agreement request will generally be automatically approved if you meet the following criteria. Tax laws are full of exceptions but the 14-day rulesometimes called the Masters exception because of its popularity in Georgia during the annual Masters golf tournamentis the most important for anyone considering renting out a vacation home. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or.

If you are an individual or business who owes more than 10000 in taxes to the IRS or your state then Fortress can help you. The IRS 10 year. That the information remains timely and accurate.

The first step towards relief is to contact Fortress Tax Relief. How long can the IRS collect back taxes. This is according to a rule known as the trust fund penalty or the 100-percent penalty.

The Electronic Federal Tax Payment System. Properly identifying how long you have before the IRS statute of limitations runs out means understanding all of the circumstances the may buy the IRS more time. For over 80 years our goal has remained the same.

When does the IRS statute of limitations period begin. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Paying electronically is a convenient way to pay your federal taxes online by phone for EFTPS.

Instead the IRS considers your filing history payment history and the amount of taxes that you owe. Learn about the 14-day rule. It is not in the financial interest of the IRS to make this statute widely known.

We collect only enough personal information to administer our programs and no more. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. This is called the 10 Year Statute of Limitations.

In the event of a failure to pay payroll taxes at all individuals within an organization may be held personally responsible. An over-the-road trucker who is away from home much of the year will save money by using the per diem allowed rather than gathering meal receipts because few people consistently spend 60-70 a day on meals. For owner-operators its deducted on IRS Schedule C and directly reduces the self-employment taxes and income taxes owed on the return.

We have experience assisting clients throughout the United States and can work on cases in any state. A taxpayer can raise to the IRS that a smaller tax debt is better than an uncollectible one and as long as the taxpayer can persuade the IRS of a realistic tax administration plan the IRS usually. After that the debt is wiped clean from its books and the IRS writes it off.

And that it is protected while we have it and that we hold it only for as long as we need it. Tax Debts up to 10000. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early.

The IRS simply wants to collect unpaid taxes not to make life miserable for delinquent taxpayers who have difficulty paying for living expenses. In addition PIAs confirm that we use the information for the purpose intended. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

Individuals and corporations are directly taxable and estates and trusts may be taxable on. The IRS issues more than 9 out of 10 refunds in less than 21 days. Get your tax refund up to 5 days early.

Income taxes in the United States are imposed by the federal government and most statesThe income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductionsIncome is broadly defined. To improve lives through tax policies that lead to greater economic growth and opportunity. The gist is that if an organization fails to pay the proper payroll taxes the IRS can hold a single person or a group of people responsible for the full amount that is owed.

Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more.

Irs Notice Cp81 Tax Return Not Received Credit On Account H R Block

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Irs Tax Letters Explained Landmark Tax Group

Santa Clara California Irs Tax Problems Help Nri Tax Group

Why Did I Receive An Irs Cp14 Notice In The Mail Your Guide What To Do With The Irs Cp14 Letter Get Rid Of Tax Problems Stop Irs Collections

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Irs Tax Problem Help Long Island New York

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

Offers In Compromise Attorney Services Polston Tax

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

2022 Irs Tax Refund Dates When To Expect Your Refund

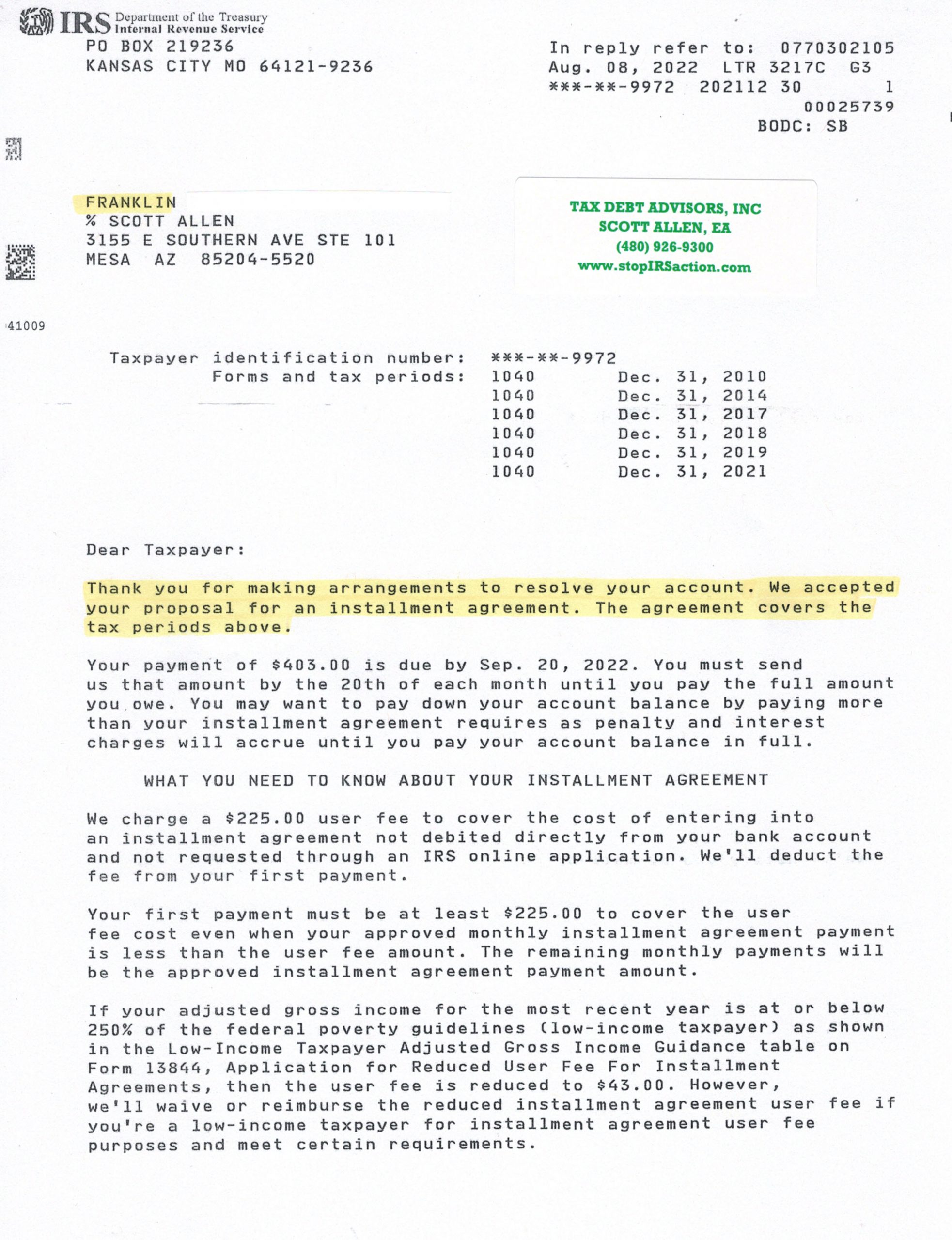

Offer In Compromise Acceptance Letter Offer In Compromise Debt Relief Programs Tax Debt

How To Pay Back Payroll Taxes Payroll Taxes Lifeback Tax

Are There Statute Of Limitations For Irs Collections Brotman Law

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Owe The Irs 10k See If You Qualify For Irs Tax Forgiveness Program